Funding Your Retirement and Beyond

Ensure You are Protected

When it comes to securing your financial future, experience and expertise matter

At Wisepath Financial Group, we provide trusted guidance to attorneys, financial advisors, and individuals nationwide. Our team of certified professionals holds CLTC (Certified in Long-Term Care) and AEP (Accredited Estate Planner) credentials, ensuring you receive top-tier financial and estate planning support.

We go beyond traditional financial services—offering comprehensive solutions that address both immediate financial needs, like beneficiary liquidity, and long-term strategies, including trust funding and long-term care insurance. No matter where you are, our nationwide reach allows us to provide expert assistance tailored to your unique financial goals.

Partner with Wisepath Financial Group and take the next step toward a secure and well-planned future.

Trust Funding: Ensuring Your Estate Plan Works as Intended

Properly funding a trust is essential to ensuring that your estate plan functions as intended. At Wisepath Financial Group, we work closely with estate attorneys and individuals to facilitate the seamless transfer of assets into your trust, helping to safeguard your financial legacy and provide for your loved ones.

Why Trust Funding Matters

Creating a trust is only the first step in effective estate planning. Without proper funding, your trust may not achieve its intended purpose, leaving assets subject to probate, unnecessary taxes, and distribution delays. By ensuring your assets are correctly titled in the name of your trust, we help you:

- Avoid probate and legal complications

- Maintain privacy and control over asset distribution

- Protect your beneficiaries from unnecessary financial burdens

- Maximize tax advantages and financial efficiency

Our Trust Funding Process

We take a proactive and personalized approach to trust funding, ensuring every detail is handled with care. Our process includes:

1. Asset Review:

Identifying assets that need to be transferred into the trust, including real estate, bank accounts, investment portfolios, and business interests.

2. Coodination with Estate Attorneys:

Working alongside your estate planning attorney to align asset titling with your trust provisions.

Retitling and Beneficiary Updates:

Ensuring all relevant accounts, property deeds, and beneficiary designations reflect the trust as the rightful owner.

4. Ongoing Support:

Providing continued guidance to ensure new assets are properly integrated into your trust as your financial situation evolves.

Take the Next Step

Funding your trust is a crucial aspect of securing your financial future and protecting your heirs. Wisepath Financial Group is here to simplify the process, providing expert guidance every step of the way. Contact us today to ensure your trust is fully funded and your estate plan is optimized for success.

The Final Piece of Your Financial Plan®

Planning for your family’s financial future means addressing every detail, even the unexpected. With a Beneficiary Liquidity Plan® (BLP), you can ensure your loved ones have the immediate financial resources they need during a challenging time—without the stress of figuring it out on their own.

What Is a Beneficiary Liquidity Plan®?

A BLP is designed to provide your beneficiaries with quick access to funds for the expenses they’re likely to encounter in the weeks or months following your passing. This is a guaranteed issue whole life policy, offering peace of mind with:

- No health questions

- No medical exams or tests

- No ongoing premium payments required

- Full access to funds within 48 hours

Avoid the Cost of Leaving Loved Ones to “Figure It Out”

Even with careful estate and financial planning, it often takes weeks—or months—for beneficiaries to access inherited funds. In the meantime, they may face thousands of dollars in out-of-pocket expenses, from funeral costs to legal fees.

Did you know?

- Many families rely on credit cards or personal savings to cover these costs.

- Over 50% of families report going into debt after the death of a loved one.²

The Beneficiary Liquidity Plan® bridges this gap, providing your loved ones with the immediate financial support they need.

What Can a Beneficiary Liquidity Plan® Cover?

The funds from a BLP can be used for a variety of expenses, including:

- Funeral or memorial service costs

- Travel expenses for loved ones

- Mortgage payments

- Medical bills

- Legal fees and other estate-related costs

Get Funds in Days, Not Months

With the Beneficiary Liquidity Plan®, your family can have access to the allocated funds within 48 hours—ensuring they can focus on what truly matters during this emotional time.

Don’t leave your loved ones to “figure it out.” Take the final step in your financial plan today.

Ready to Secure Your Family’s Future?

Speak with our team today. Let us help you provide the financial stability and peace of mind your loved ones deserve.

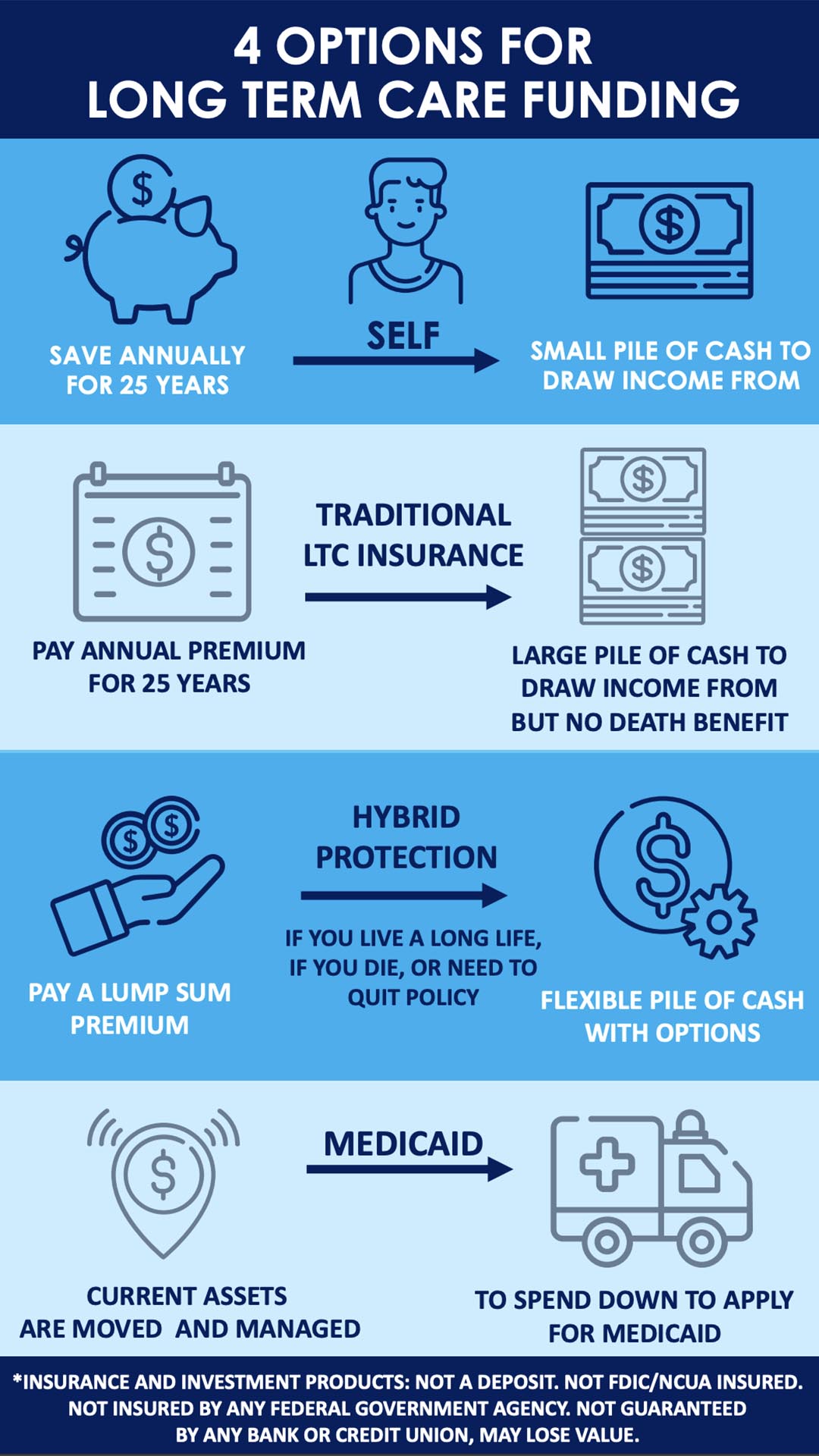

Long-Term Care Planning: Protecting Your Future

Planning for long-term care is a crucial step in securing your financial future and ensuring you receive the care you need without burdening your loved ones. At Wisepath Financial Group, we provide comprehensive long-term care insurance solutions that offer financial protection for extended care—whether at home, in an assisted living facility, or in a nursing home.

Why Long-Term Care Planning Matters

As healthcare costs continue to rise, long-term care expenses can quickly deplete savings. Without a solid plan in place, individuals may face financial strain or rely on family members for support. Our long-term care planning solutions help you:

- Cover the costs of home care, assisted living, or nursing home care

- Protect your assets and retirement savings

- Reduce the financial and emotional burden on family members

- Maintain independence and choice in your care options

Our Approach to Long-Term Care Insurance

We work with trusted insurance providers to tailor policies that meet your unique needs and budget. Our process includes:

- Personalized Assessment: Evaluating your financial situation, health status, and care preferences to determine the best coverage options.

- Policy Comparison: Analyzing policies from top-rated insurance providers to ensure you receive the best benefits at the most competitive rates.

- Customized Solutions: Structuring a policy that balances coverage, affordability, and flexibility for future needs.

- Ongoing Support: Providing continued guidance as your circumstances change to keep your coverage aligned with your needs.

Secure Your Peace of Mind Today

Long-term care planning is an essential part of a well-rounded financial strategy. Wisepath Financial Group is here to help you prepare for the future with confidence. Contact us today to explore your long-term care insurance options and protect your financial well-being.